3 hours agoAuthor: Shivakant Shukla

- copy link

This In the digital age, UPI (Unified Payments Interface) has made transactions very easy. However, there are some dangers with this feature. Scams related to UPI keep coming to the fore often. Now cyber criminals have found a new way of scam through UPI. This scam has increased the concern of common UPI users as well as cyber crime agencies.

In this scam, cyber criminals first deposit a small amount in the user’s account and then cleverly withdraw the large amount. This has been named ‘Jumped Deposit Scam’. A few days ago, the Cyber Crime Wing of Tamil Nadu was the first to catch this new scam.

Tamil Nadu Cyber Crime Police has warned that not only unknown calls or links, but also sudden withdrawal of money in the account can be a danger signal.

So, today in our cyber literacy column we will talk about ‘Jumped Deposit Scam’. You will also learn that-

- How do cyber criminals execute jumped deposit scams?

- What things are important to keep in mind for safe use of UPI?

Expert: Rahul Mishra, Cyber Security Advisor, Uttar Pradesh Police

Question- What is jumped deposit scam?

answer- This is a new UPI based cyber fraud. In this, fraudsters first deliberately transfer a small amount to the user’s bank account, so that the user gets attention. When money comes suddenly, people often open the UPI app to check the balance or to see where the money has come from. During this time, fraudsters send fake ‘UPI money requests’.

The user quickly enters the UPI PIN to check the balance. But unknowingly he approves that payment request. As soon as the PIN is entered, a large amount of money is transferred from the account to the fraudster’s account.

In some cases, fraudsters call or message and claim that ‘money has been sent by mistake, please return it.’ As soon as the user visits the app, cyber criminals commit fraud by sending fake money requests.

Question- How do cyber criminals carry out jumped deposit scams?

answer- Suppose you suddenly get a message of Rs 50 being deposited in your account through UPI. To see this, you immediately open the bank app and enter the PIN to check the balance. Meanwhile, the fraudster sends you a fake money request to send Rs 500.

Since you are already in the app, you do not pay attention and consider the request correct and enter the PIN again. Due to this, the entire Rs 500 goes into the swindler’s account. Understand this from the graphic given below-

Question- Why do people easily fall prey to this scam?

answer- When money suddenly comes into the account, people often go to the app to check the source and balance. Apart from this, due to the fast and easy process of UPI, people accept money requests without paying any attention. Cyber criminals take advantage of this haste and lack of digital information.

Often users do not understand that entering PIN for checking balance and sending money are different actions. This confusion and haste makes the user a victim of scam.

Question- What precautions are necessary to avoid jumped deposit scam?

answer- To avoid this scam, UPI users need to exercise some wisdom and patience. Taking any hasty step after seeing the sudden amount of money in your account can lead to loss. For this, take special care of some things.

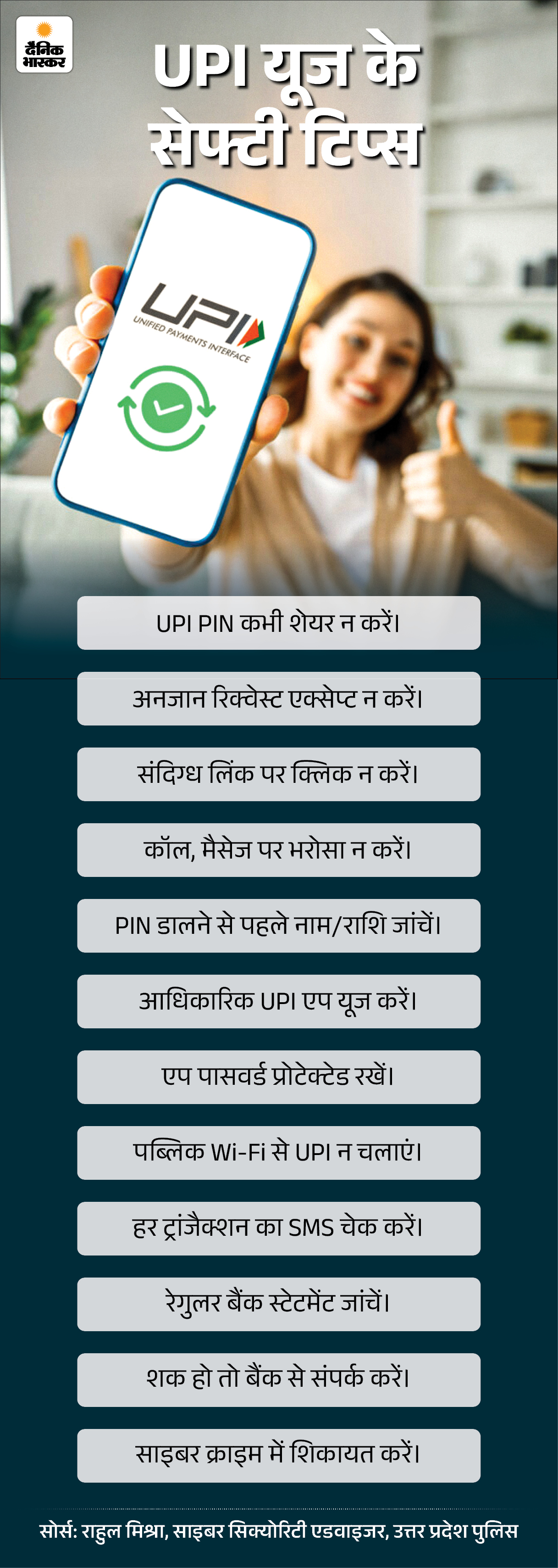

Question- What things are important to keep in mind and what precautions are necessary for safe use of UPI?

answer- Vigilance and correct information are very important for safe use of UPI. Being hasty in any digital transaction, trusting unknown calls/messages and making payments without checking can lead to losses. Understand the safety tips for using UPI from the graphic given below-

Question- Can fraud occur just by checking the balance?

answer- Cyber security advisor Rahul Mishra says that generally checking the balance does not lead to fraud. But it is very important to be cautious during this time. If at that very moment a fake money request comes and the user accepts it without paying any attention, then fraud may occur.

Question- What should be done if a call or message comes to return the money?

answer- In such a situation, do not panic and react immediately. The best way is to directly contact the customer care of your bank or UPI app. Apart from this, you can also ask the caller to come to your nearest police station and collect the cash. If necessary, lodge a complaint on cyber crime helpline.

Question- What should be done immediately if you accidentally become a victim of jumped deposit scam?

answer- In such a situation, do not panic, take some action immediately. Without any delay, call the customer care of your bank or UPI app and inform about the fraud. Block all transactions immediately. Also call National Cyber Crime Helpline (1930) or Register complaint on the portal. Keep in mind, the sooner the report is filed, the greater the chances of getting the money back.

………………

Read this news also

Cyber Literacy- Your WhatsApp account can be hacked: Beware of ghost pairing scam, government warns, know ways to protect yourself

WhatsApp is a popular messaging app. According to ‘World Population Review’, by the year 2024, more than 85 crore people were using it in India. This figure might have increased even more now. Read further…

&w=360&resize=360,240&ssl=1)