- Hindi News

- Lifestyle

- Credit Card Scam; Uttarakhand Credit Card Limit Extension Fraud Case | Cyber Alert

9 hours agoAuthor: Gaurav Tiwari

- copy link

Recently, a person was cheated of Rs 2.35 lakh in Rudraprayag, Uttarakhand. The person had received a call from an unknown number, in which scammers had lured him to increase his credit limit. In this process, one was asked to install the app through a link. Soon after this the mobile got hacked and his bank account was emptied.

In the last few days, frauds are increasing rapidly in the name of increasing the credit card limit. Fraudsters call you pretending to be bank officials, win your trust and then empty your bank account by taking link, OTP or card details.

Last month, a similar case came to light in Mumbai also. Where a person was cheated of Rs 2.45. The good thing was that due to timely complaint, the amount was returned, but it is not necessary that this happens in every case. Often people do not complain due to fear or lack of information.

Today cyber literacy In the column, we will talk about the fraud taking place in the name of increasing the credit card limit. You will also learn that-

- How do fraudsters commit credit limit fraud?

- What is the right way to increase credit card limit?

- What steps should be taken immediately if fraud occurs?

Expert: Rahul Mishra, Cyber Security Advisor, Uttar Pradesh Police

Question- What is ‘Credit Limit Fraud’?

answer- This is a type of digital and financial fraud.

- In this, fraudsters pretend to increase the credit card limit.

- Scammers contact through phone call, SMS, WhatsApp or e-mail.

- They claim that no document will have to be given for this.

- They say the credit limit will increase immediately.

- Many times he describes himself as a bank official.

- After gaining trust, they ask for OTP, CVV or card details.

As soon as the scammers get the information, they withdraw money from the account. The victims of this fraud are mostly those people who want to increase their credit limit quickly.

Question- What methods do fraudsters resort to to prove themselves as bank officers?

answer- For this, thugs adopt these methods-

- While calling, the fraudsters pretend to be representatives or officers of the bank.

- Sometimes the name of a bank also appears in the caller ID.

- Bank logo is used in profile photo on WhatsApp.

- Use bank like design and signature in e-mail.

- Win trust by telling some basic information about the user.

- Then it says that your card is in ‘pre-approved’ category.

- Put pressure on them to take a quick decision.

- Psychologists use both fear and greed.

Question- What are the ‘red flags’ in fraud calls or messages, which should not be ignored?

answer- There are several common red flags seen in this type of fraud. Like getting an offer to increase the credit limit without request. Pressure should be repeatedly put on calls to take quick decisions. OTP, CVV or credit card number may be asked.

See all the red flags of fraud in the graphic-

Question- What information do fraudsters steal in the name of increasing credit card limit?

answer- Usually fraudsters ask for such information-

- Complete credit card number.

- Expiry date of card.

- CVV Number, it is a 3 digit number written on the back of the card.

- OTP is required to complete the transaction.

- Net banking or mobile app log-in details.

- Registered mobile number information.

- E-mail ID and password.

- In many cases PAN or Aadhaar details.

Through this information, fraudsters gain complete control over the card and account.

Question- What common mistakes do people often make, due to which they become victims of such frauds?

answer- Generally people make these common mistakes-

- Trust unknown calls or messages immediately.

- Let’s assume that the bank never makes a wrong call.

- Share OTP.

- Get tempted to increase the limit quickly.

- Click on any link.

- Not checking offers on bank app or website.

- Taking hasty decisions under fear or pressure.

- Being influenced by words like free, pre-approved.

- Lack of knowledge about cyber fraud is also a big reason.

Question- What is the process to get the money back in case of an unauthorized transaction and how much time does it take?

answer- This may take approximately 7 to 45 days-

- First of all, block the credit card immediately.

- Register a complaint with the bank’s customer care or mobile app.

- Please also send written complaint through e-mail.

- The bank starts the verification process of the transaction.

- The chargeback process is applied during the investigation.

- If the user is not at fault, the refund process starts.

- The time limit is fixed as per RBI rules.

- Usually it may take 7 to 45 working days.

- Complaining early increases your chances of getting a refund.

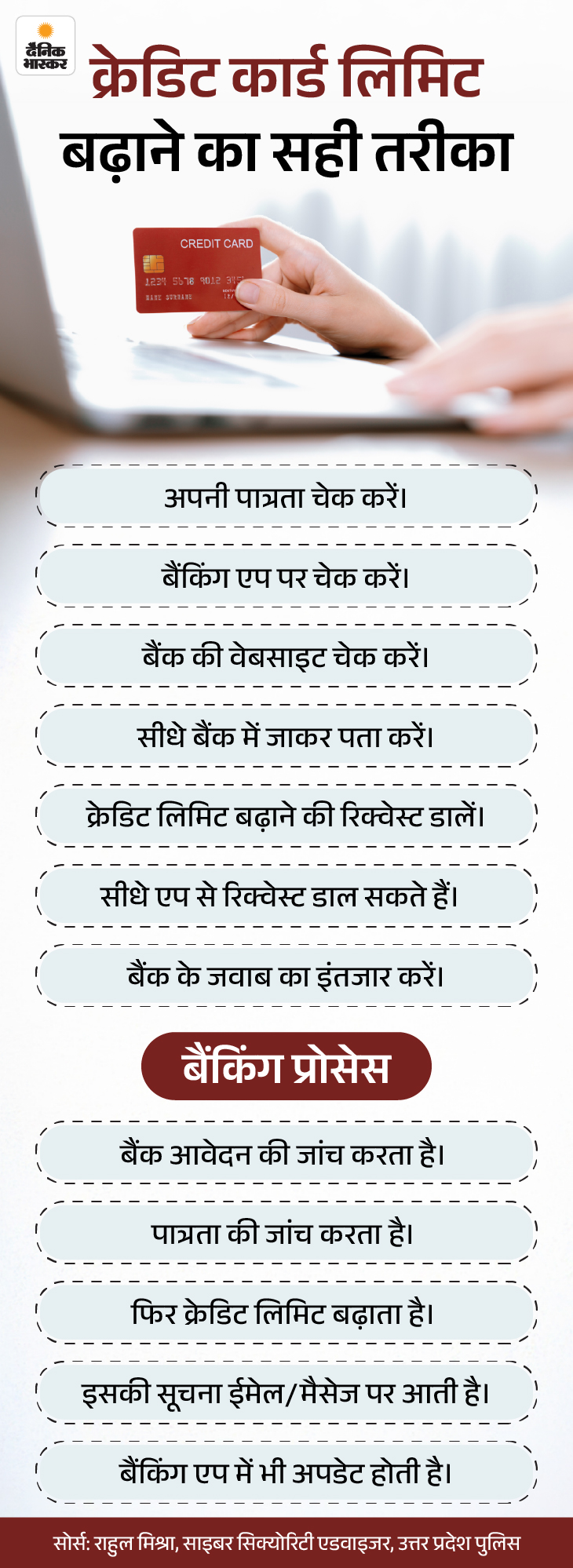

Question- What is the right and safe way to increase credit card limit?

answer- Banks increase credit card limits officially. Use only the official app or website of the bank. Consider only the official SMS or e-mail sent by the bank. See the correct method in the graphic-

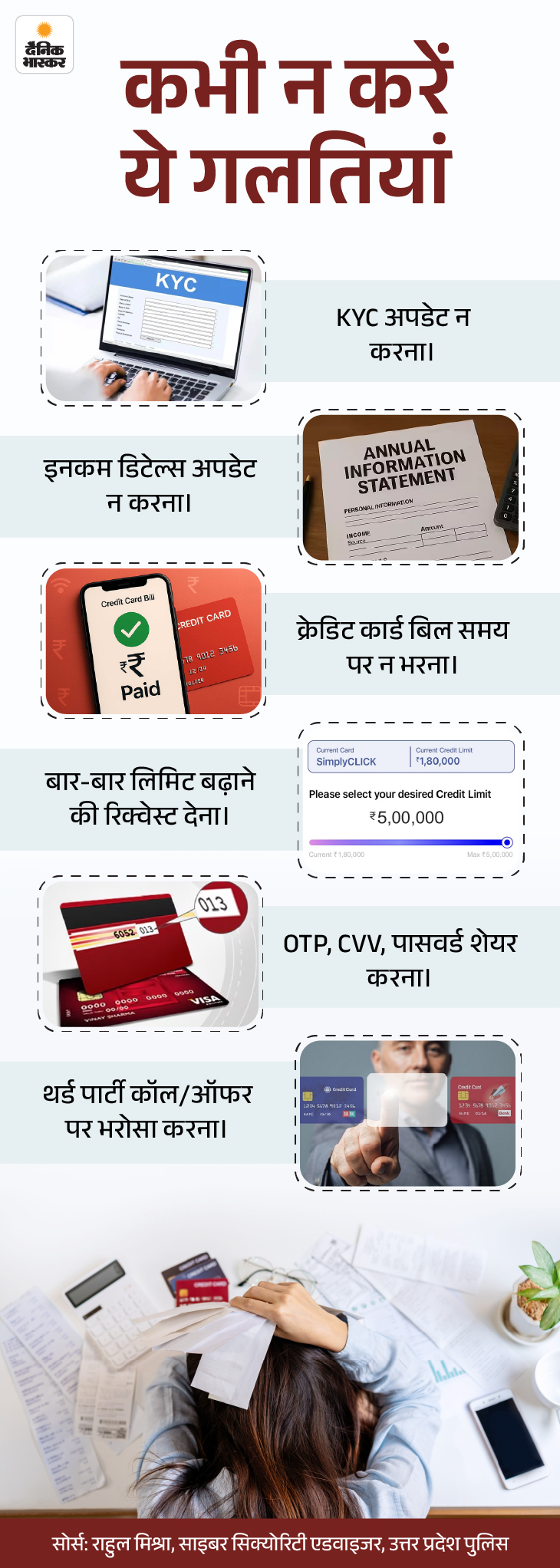

Question- What mistakes should any credit card user never make?

answer- If you use a credit card, it is very important to know what mistakes should not be made. Look at the graphic-

Question- On what conditions does the bank itself increase the limit and where should the user check the official offer?

answer- Banks increase the credit limit on these conditions-

- Regular and timely bill payments.

- Good and stable credit score.

- Use the card responsibly.

- Increase in income or profile upgrade.

- Being a long time customer of the bank.

- Low late fees and no defaults.

- The bank itself gives offers through app, official SMS or e-mail.

- The user should check the offer on the bank app, net banking or website only.

- Never consider an unknown call as official.

……………… Read this news also Cyber Literacy- Scam happening in the name of internship: How to identify if the job offer is fake, 11 precautions necessary for protection

Cyber criminals are adopting new methods of fraud every day. Now they are targeting college students who are looking for internships. Cyber thugs are cheating the youth by showing attractive offers like good salary and guaranteed placement in the name of internship. Read further…

&w=360&resize=360,240&ssl=1)