- Hindi News

- Lifestyle

- Best Saving Schemes For Women; MSSC Interest Rate | Post Office NSC Return Benefits

2 hours ago

- copy link

Women today are fulfilling responsibilities on every front from home to office. Despite this, many women do not have economic independence. Therefore, every woman wants to have a financial plan that not only fulfills her needs but also secures her future.

In such a situation, if they have information about some such savings schemes which provide safe returns, then they can become self-reliant. Many savings schemes of the government and banks provide better returns on small investments. Some of these schemes have been made especially for women.

today we your money We will learn about 4 such saving schemes in this column. You will also learn that-

- Who can invest in these schemes?

- What is the right way to invest in these?

Question- Which are the best government saving schemes for women?

answer- The Government of India has launched many investment schemes for the common man. Among these, schemes like Sukanya Samriddhi have been started especially for women. These schemes are a great option for safe, stable and profitable investments. Most of these are common schemes, which provide good returns and the investment is safe. Look at the graphic-

Let us understand all these schemes in detail-

Sukanya Samriddhi Yojana

This government scheme has been started to secure the education and future of daughters. In this, parents or guardian can open an account in the name of a girl child below 10 years of age.

advantages

- In this, higher interest is available as compared to normal savings account.

- Presently it gives compound interest of 8.2% per annum.

- Investments made in this get tax exemption under section 80C.

- This is an ideal plan for long term goals like daughter’s education and marriage.

National Savings Certificate

This is a fixed term deposit scheme of the post office, in which the maturity period of 5 to 10 years can be chosen.

advantages

- A fixed interest rate is available in this.

- Tax exemption is available on investment under section 80C.

- This is a good option for long term and tax saving.

Post Office Fixed Deposit Scheme

In this post office scheme, interest can be obtained by depositing the amount for a fixed period. Its time limit ranges from 1 year to 5 years.

advantages

- You can choose the deposit period as per your need.

- Better interest rates are available compared to banks.

- This is a reliable scheme for short and medium term investment.

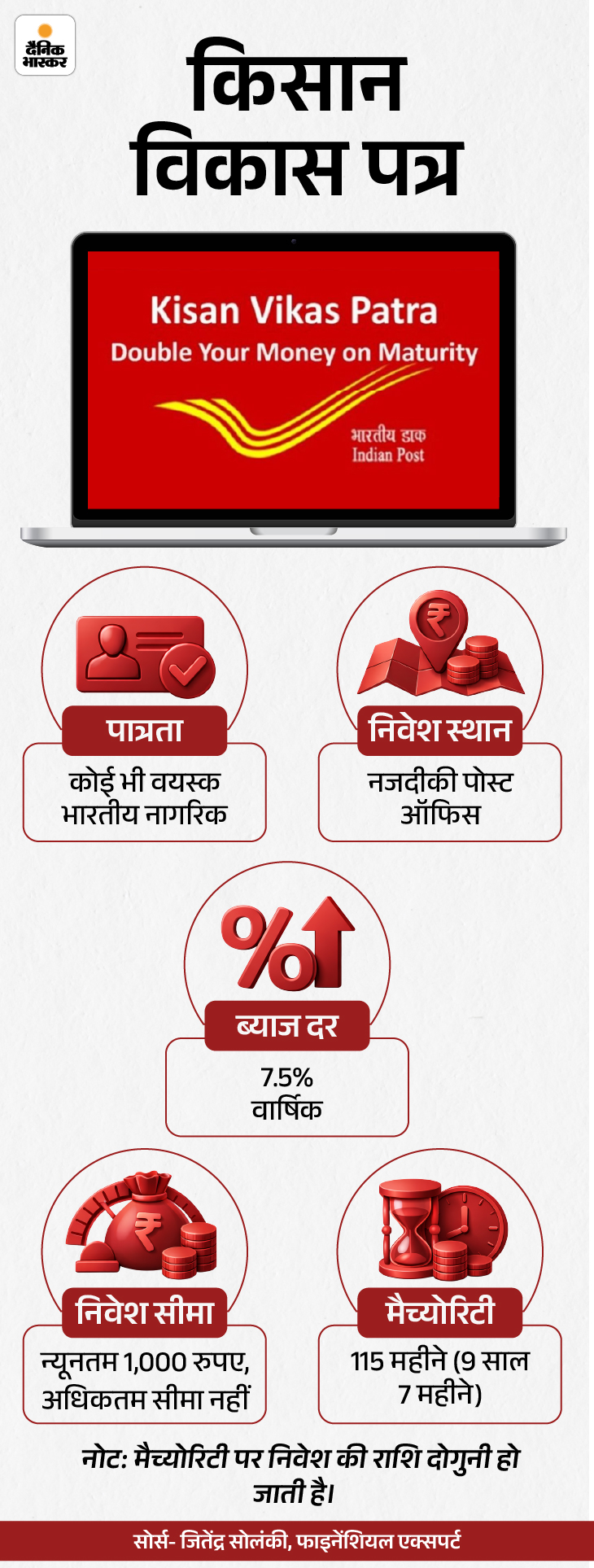

Kisan Vikas Patra

This is a government savings scheme, the objective of which was to encourage farmers to save. The government has further expanded this scheme, now all citizens can invest in it. In this, a big fund can be created by investing long term instead of short term.

advantages

- In this scheme the money doubles in 115 months (9 years 7 months).

- Gets better returns than savings account.

- The interest received on investment is fixed.

- You can easily open an account in any bank or post office.

Question- Some other schemes for investment, where women should invest?

answer- Apart from the schemes mentioned above, there are some government and some non-government schemes, where women can invest and secure the future of themselves and their families.

Unit Linked Insurance Plan (ULIP)

ULIP is a plan which provides investment facility along with insurance protection. In this, women can choose equity or debt funds according to their risk tolerance (ability to take risk). There is also an option to switch funds from time to time. In the long run, this plan helps in wealth creation and can prove to be an effective financial tool for major goals like children’s education or retirement. ULIP can yield annual returns of 8% to 12% in the long term.

Capital Guarantee Plan

This scheme is suitable for those women who want to keep their savings safe while avoiding risk. In this, the principal amount invested is fully guaranteed on maturity and fixed returns are available. Therefore this plan is considered a stable and reliable investment option for short to medium term financial needs. Capital guarantee plans generally provide annual returns of 6% to 8%.

pension schemes

Pension plans provide women with the security of regular income after retirement. Disciplined investment over a long period of time (consistent investment without gaps) creates a strong corpus, which provides an assured pension every month after retirement. This scheme is especially important for those women who want to be financially independent in the future. These usually give annual returns of 6% to 8%.

National Pension Scheme (NPS)

NPS is a government retirement scheme, which is considered a reliable option for long term investment. In this, one gets the option of balanced investment in equity, debt and government bonds. Tax exemption is also available in this. The current interest rate on National Pension Scheme is 6.95% per annum.

Public Provident Fund (PPF)

PPF is a safe and tax-free long term savings scheme, which encourages women to save regularly. It has a lock-in period of 15 years, which helps in making disciplined investments. The interest received on it and the maturity amount are completely tax-free, which makes it a very effective investment option. Public Provident Fund is currently offering interest at the rate of 7.1% per annum.

……………… Read this news also Your money- Invest only Rs 340 daily: You will get a fund of Rs 7 lakh in 5 years, know what is Post Office RD Scheme, how to invest

If you have a lot of money at once, you can make a fixed deposit (FD). But if you don’t have that much money at once, then just save a little bit every month. Post office schemes are quite reliable and useful for saving and building a big fund. Read further…

&w=360&resize=360,240&ssl=1)

&w=360&resize=360,240&ssl=1)