- Hindi News

- Lifestyle

- SCSS Benefits Explained; Senior Citizen Savings Scheme Interest Rate & Rules

10 hours agoAuthor: Gaurav Tiwari

- copy link

retirement The biggest question after this is that how will the expenses be managed without regular income?

If you have not done any pension planning in advance, then the problems may increase further. However, the good thing is that the Government of India has made many such schemes for senior citizens, through which they get a fixed amount every month.

One of these schemes is – Senior Citizen Saving Scheme, in which people of 60 years of age and above get secure returns.

so today ‘your money‘ Will talk about ‘Senior Citizen Saving Scheme’ in the column. You will also learn that-

- Who can get the benefit of this government scheme?

- How much pension can I get every month?

Expert: Rajasekhar, Financial Expert

Question- What is Senior Citizen Saving Scheme (SCSS)?

answer- Senior Citizen Savings Scheme (SCSS) is a government savings and pension scheme. It is specially designed for people aged 60 years and above.

On depositing money in this savings scheme, along with interest, pension is also received every three months, due to which regular income remains after retirement.

Tax exemption is also available in this. Therefore, it is a good option for investment and pension for senior citizens.

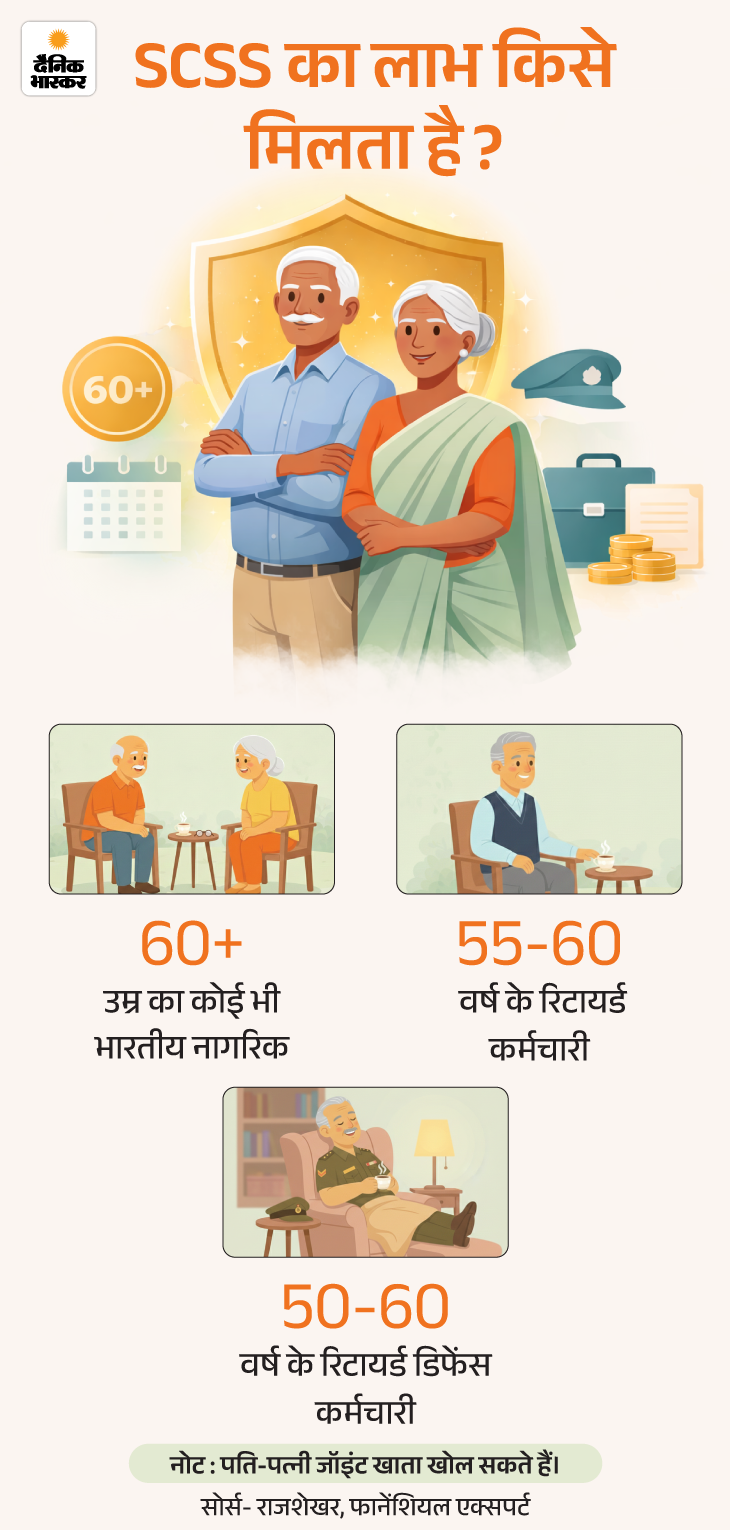

Question- Who can invest in Senior Citizen Saving Scheme?

answer- To invest in SCSS scheme, it is necessary to fulfill certain criteria. Let us understand this graphically.

Question- How much can senior citizens invest in the savings scheme?

answer- In this you can invest a maximum of Rs 30 lakh at a time. If both husband and wife have separate accounts, then a total of up to Rs 60 lakh can be deposited.

Investment in this scheme can be started with a minimum of Rs 1,000. It is worth noting that money can always be deposited in multiples of 1,000 only. That means 1000, 2000, 3000…

In this, the money has to be deposited together i.e. in lump sum, it cannot be paid in installments. By investing the amount received after retirement like PF (Provident Fund) or gratuity here, you can earn regular income with good interest every quarter.

Question- What is the interest rate and how much pension is available in the Senior Citizen Saving Scheme?

answer- The current interest rate in this is 8.2% per annum. Interest gets credited to the account every three months. For example, an investment of Rs 30 lakh gives an annual regular income of Rs 2.46 lakh i.e. approximately Rs 20,500 per month.

Let us understand all the features of the Senior Citizen Saving Scheme in detail.

Safe Investment: This is a government scheme. Therefore, the money invested in it remains safe and gets fixed returns at the stipulated time.

Interest Rate: Currently interest is given at the rate of 8.2% per annum (for the first quarter of the financial year 2025-26).

input range: Minimum investment can be made up to Rs 1,000 and maximum Rs 30 lakh.

Investment Method: Investment up to Rs 1 lakh can be made in cash. For amounts exceeding this, payment through check is mandatory.

Duration: The basic duration of the scheme is 5 years, which can be extended by 3 more years. Application for extension has to be made within one year of maturity.

Account Transfer Facility: Account can be transferred between post office and bank. This facility is available all over India.

Nominee Facility: Nominee can be appointed at the time of opening the account or later.

Question- Is there tax exemption available on investing in Senior Citizen Saving Scheme?

answer- Yes, investing in SCSS provides tax exemption benefits.

- Under Section 80C of the Income Tax Act, exemption of up to Rs 1.5 lakh is available.

- This exemption is applicable only on the original investment amount.

- The interest received in the scheme is fully taxable.

- TDS is deducted if the annual interest exceeds Rs 50,000.

- Relief from TDS can be availed by submitting Form 15H/15G.

- SCSS is useful for tax planning, but keep in mind the tax on interest.

Question- Can I withdraw money before maturity?

answer- Yes, money can be withdrawn before maturity in Senior Citizen Savings Scheme, but there may be a penalty on this. If the account is closed within a year, the interest received on the principal amount is withdrawn. There is a reduction of 1.5% between 1-2 years and 1% after 2 years.

Question- Where and how to open SCSS account?

answer- SCSS account can be opened in any authorized bank or post office. For this, documents like Aadhar card, PAN card and age proof are necessary. The account can be easily opened by filling the prescribed form and depositing a lump sum amount, thereby starting quarterly earnings.

Question- Can I open more than one account?

answer- Yes, a person can open more than one account in SCSS, but the total investment in all the accounts should not exceed Rs 30 lakh. Apart from this, joint account can be opened only with life partner. The amount deposited in this account is considered to be in the name of the account holder first.

Question- Can a nominee be added to it?

answer- Yes, facility to add nominee in SCSS account is available. Nominee can be named at the time of opening the account or even later. One or more nominees can be added, making transfer of funds easy and secure in the event of death of the account holder.

Question- Can the interest rate change?

answer- The interest rate of SCSS is decided every quarter by the government. Therefore it may change from time to time. However, once you invest, the interest rate applicable on that account remains fixed for the entire tenure and is not affected by future changes.

Question- Is regular cash flow planning easy in SCSS?

answer- Yes, SCSS offers fixed interest on quarterly basis, thereby maintaining regular and predictable cash flow. It makes budgeting easier for retired people and helps them systematically manage everyday expenses, such as medicines or household expenses.

Question- For which people is it most beneficial?

answer- SCSS is most beneficial for those who are retired and have a lump sum amount available, such as PF or gratuity. It is especially suitable for investors who want secure and regular income with low risk.

Question- What mistakes should be avoided while investing in SCSS?

answer- It is important to avoid some mistakes when investing in SCSS. As-

- Investing all the money in one scheme.

- Ignoring taxes.

- Do not keep emergency funds aside.

Note: It is important to adopt a balanced investment strategy instead of relying only on interest.

Question- What is the difference between SCSS and FD?

answer- SCSS is a government scheme, which currently offers fixed interest of 8.2% and quarterly income, whereas FD is a bank product, in which the interest rate is relatively low or keeps changing. SCSS has a lock-in of 5 years, whereas FD offers more flexibility and different tenure options.

Question: Can SCSS meet all retirement needs?

answer- No, SCSS alone cannot meet all retirement needs. It is a good source of secure and regular income, but for better financial planning, it should be used in combination with other investment options like FD, bonds and mutual funds to provide both growth and security.

……………… Read this news also Your Money – What is Kisan Vikas Patra: In how many days money doubles, who can invest, know the complete process of taking KVP

While investing, every person wants his money to be safe and also to get good returns. This is very difficult amid market fluctuations. However, one such government small savings scheme with safe and fixed returns is Kisan Vikas Patra (KVP). This is a low-risk investment option, in which the invested amount almost doubles in the stipulated period. Read further…

&w=360&resize=360,240&ssl=1)

&w=360&resize=360,240&ssl=1)